VALYU.ai – Empowering India's Workforce with On-Demand Earned Wages

VALYU.ai – Empowering India’s Workforce with On-Demand Earned Wages

With Dynamic Contents, you can create personalized pages by populating data from various sources and design your own replicable portfolio layout.

About

VALYU.ai ventured into the salary solution space with a groundbreaking mission: to provide employees instant access to their accrued earnings directly into their salary accounts. Positioned as an advanced salary service, VALYU.ai aimed to significantly reduce financial stress on the Indian workforce by enabling better management of monthly expenses and absorption of unexpected financial shocks. By ditching the traditional "payday wait," VALYU.ai sought to empower employees with flexible access to earned wages anytime, anywhere, facilitating better financial health and liquidity through secure partnerships with NBFCs and employers.

Styles

Change the color to match your brand or vision, add your logo, choose the perfect layout, modify menu settings and more.

Challenges

To disrupt the traditional pay cycle and establish a sustainable, impactful solution, VALYU.ai navigated critical challenges:

Ensuring Secure & User-Friendly Digital Access

Designing a fully digital e-KYC and salary access experience required paramount security for financial transactions while maintaining intuitive ease of use for a broad user base.

Building Trust with Employers & NBFCs

Convincing corporations to partner for salary advances without traditional credit checks, and ensuring seamless integration with NBFCs, presented a significant hurdle.

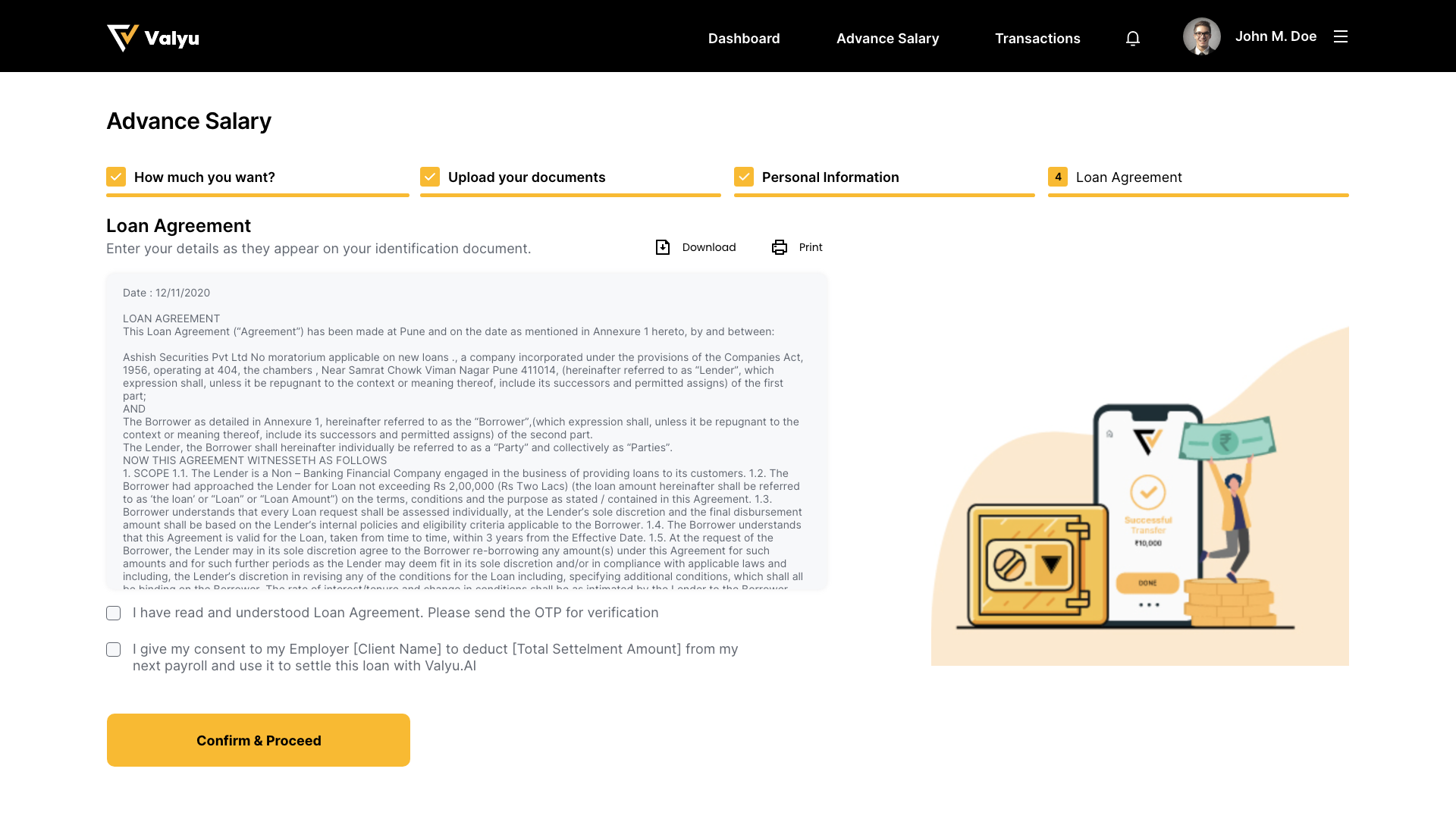

Balancing Transparency with Business Viability

Implementing a sustainable business model with clear, minimal withdrawal fees while avoiding hidden charges and interest was a key challenge.

Scalability for Mass Adoption

Designing a tech-driven solution capable of delivering a fully automated and personalized user experience at scale to over one million Indian workers, while maintaining high performance and reliability.

Solution

I partnered with VALYU.ai to design a robust, secure, and user-centric fintech platform.

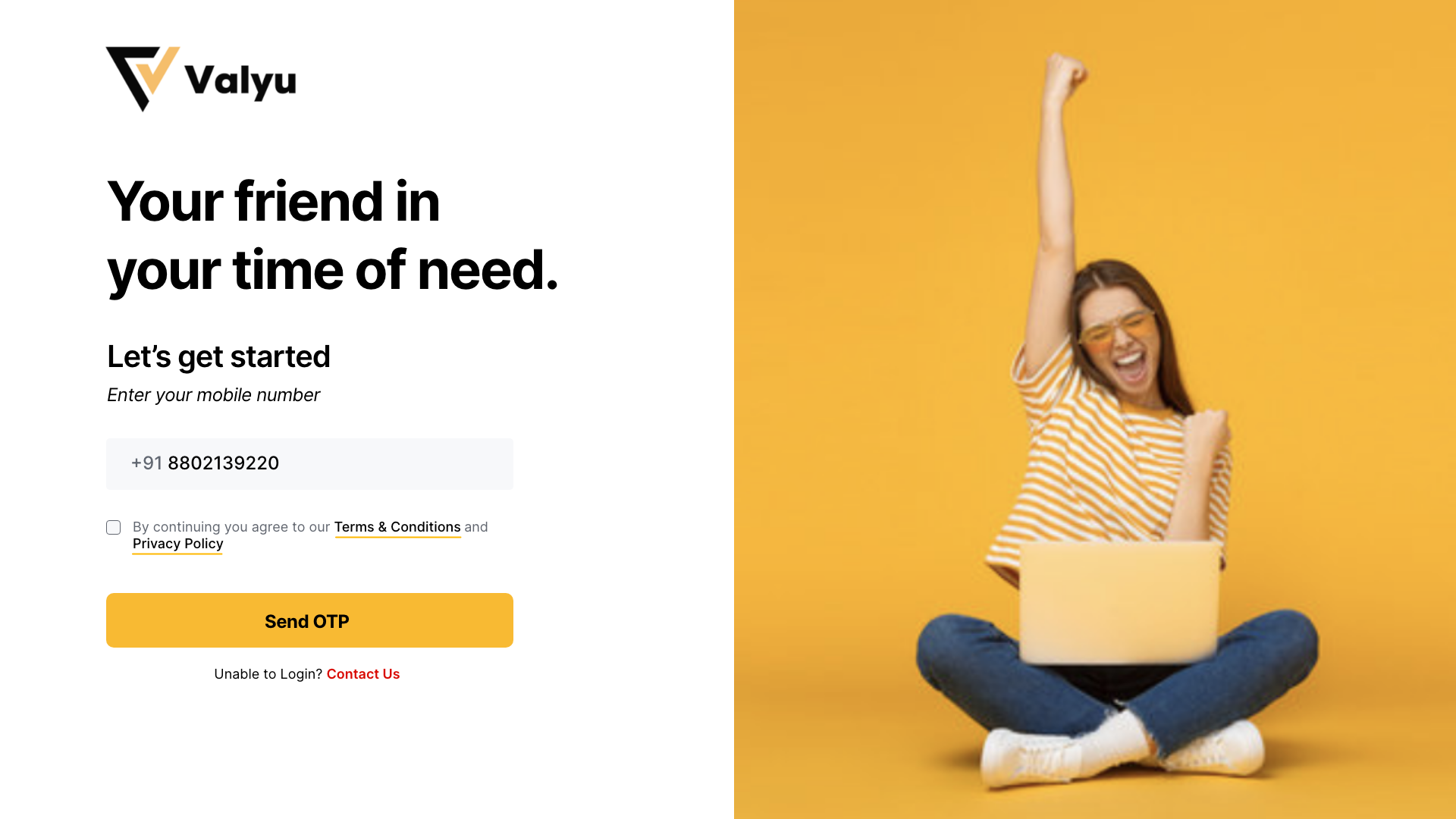

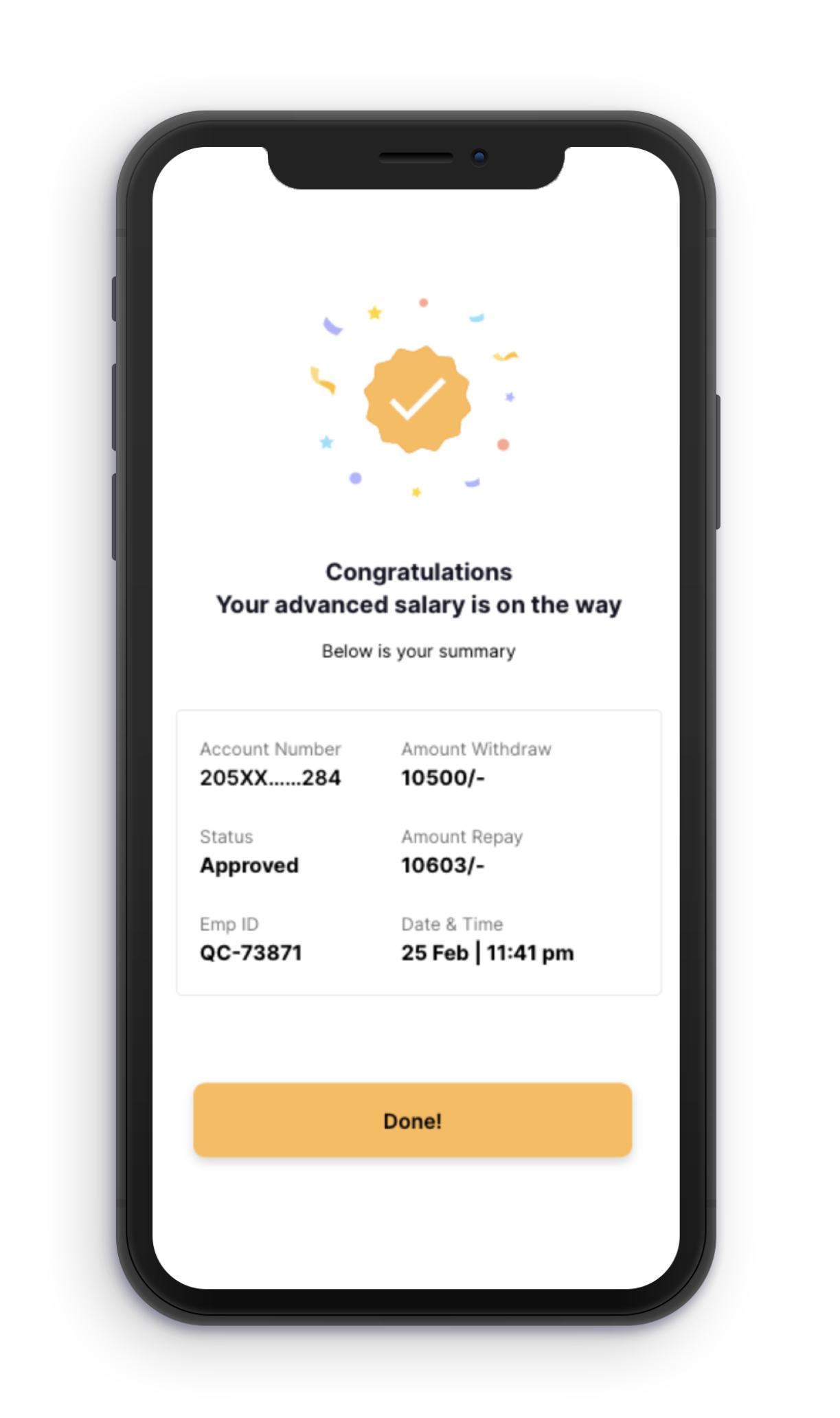

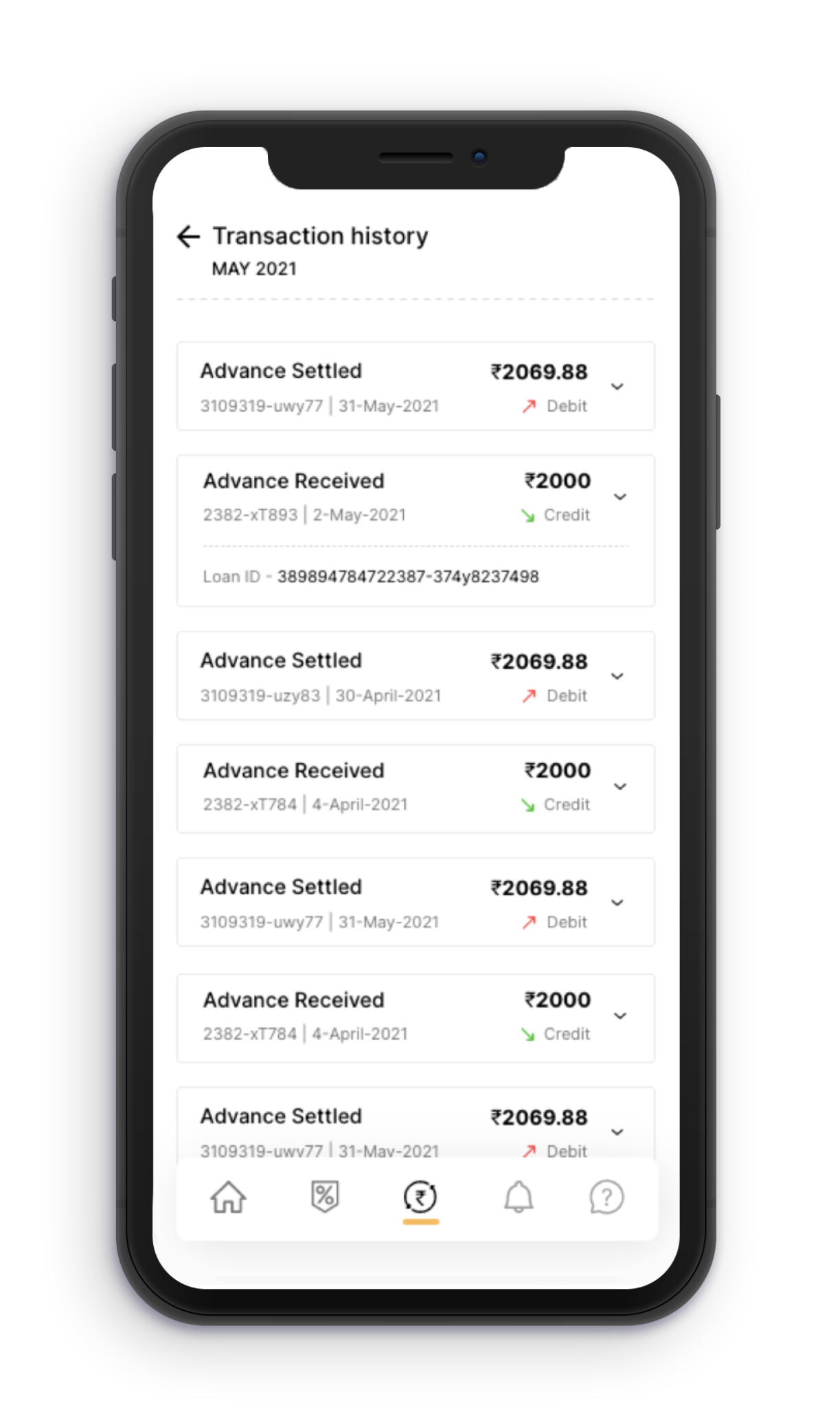

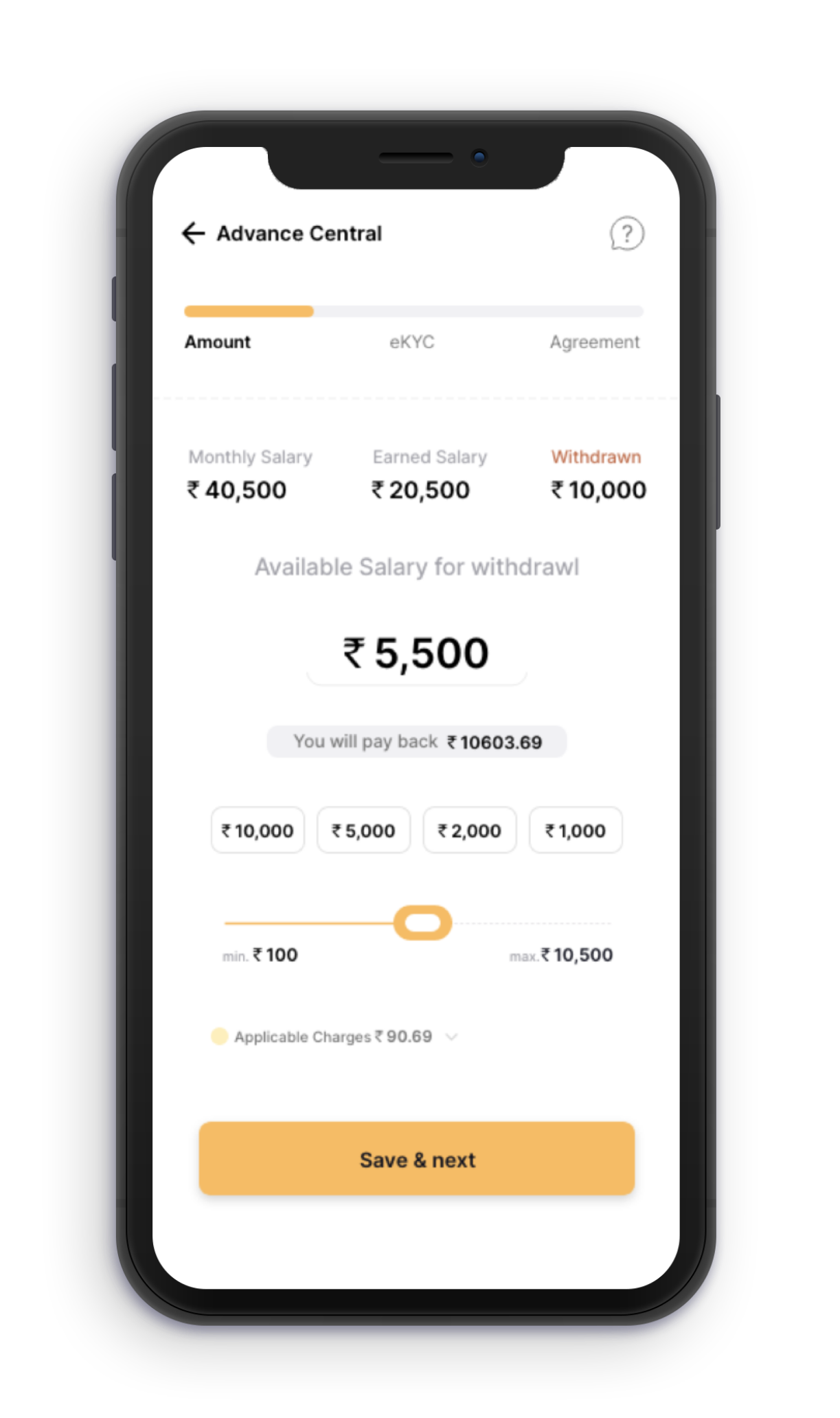

Mobile-First Experience

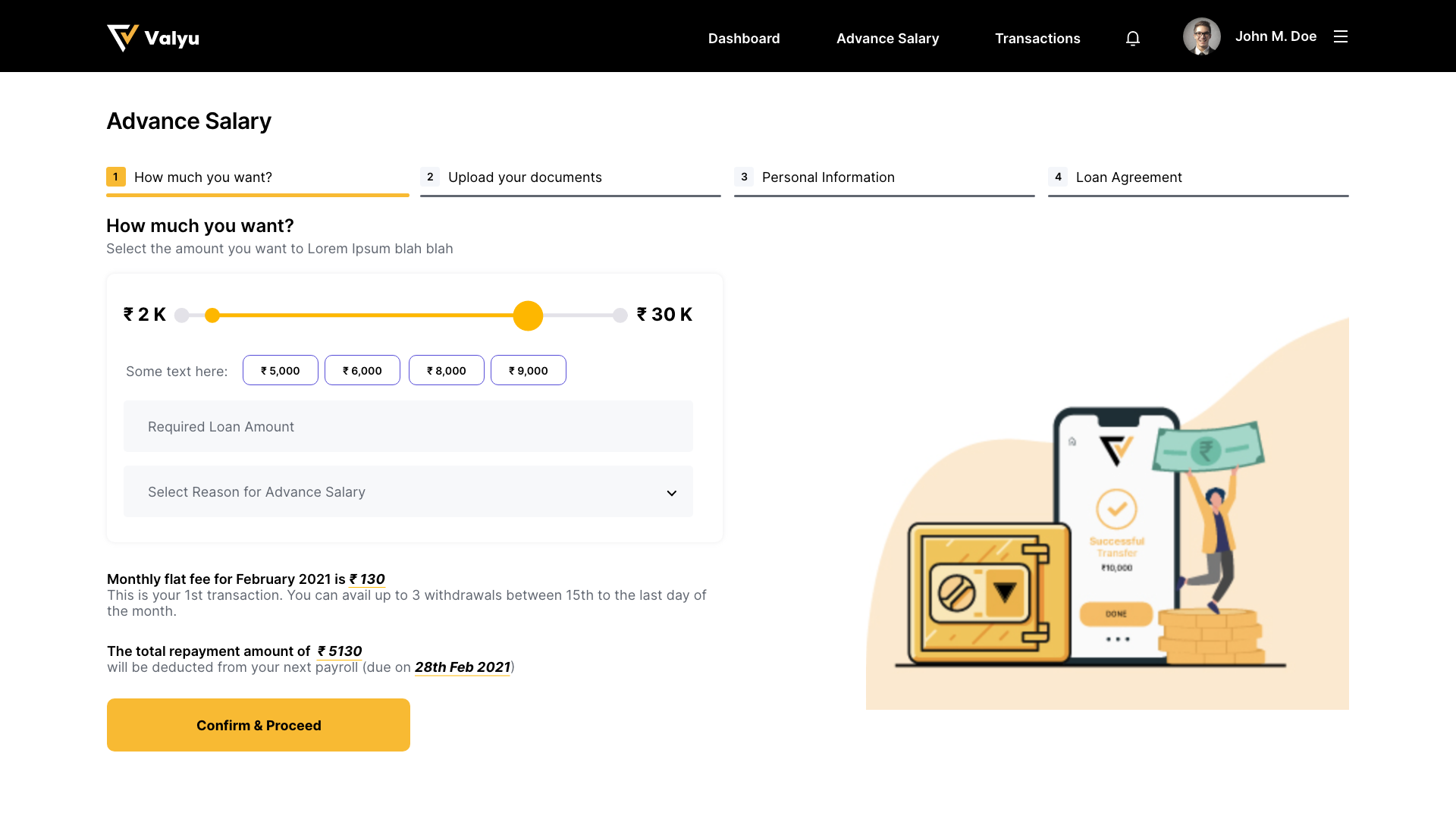

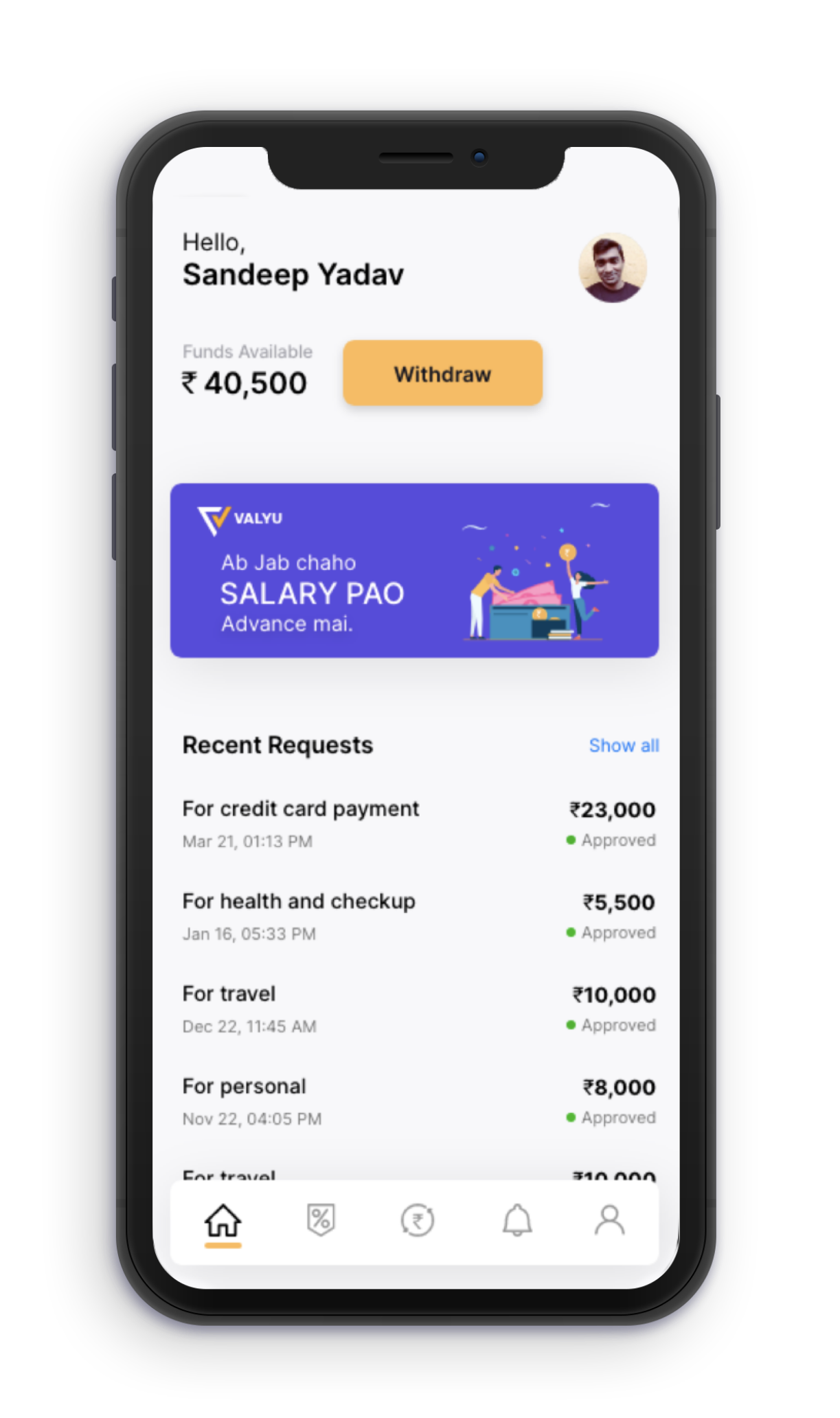

Built an intuitive app for quick wage access with seamless onboarding, e-KYC, fund selection, and secure transactions.

AI-Powered Insights (Sensei)

Integrated AI to provide personalized money management, proactive budgeting, and ML-driven risk assessment.

Transparent Fee Model

Designed clear transaction flows with upfront communication of minimal fees, fostering trust.

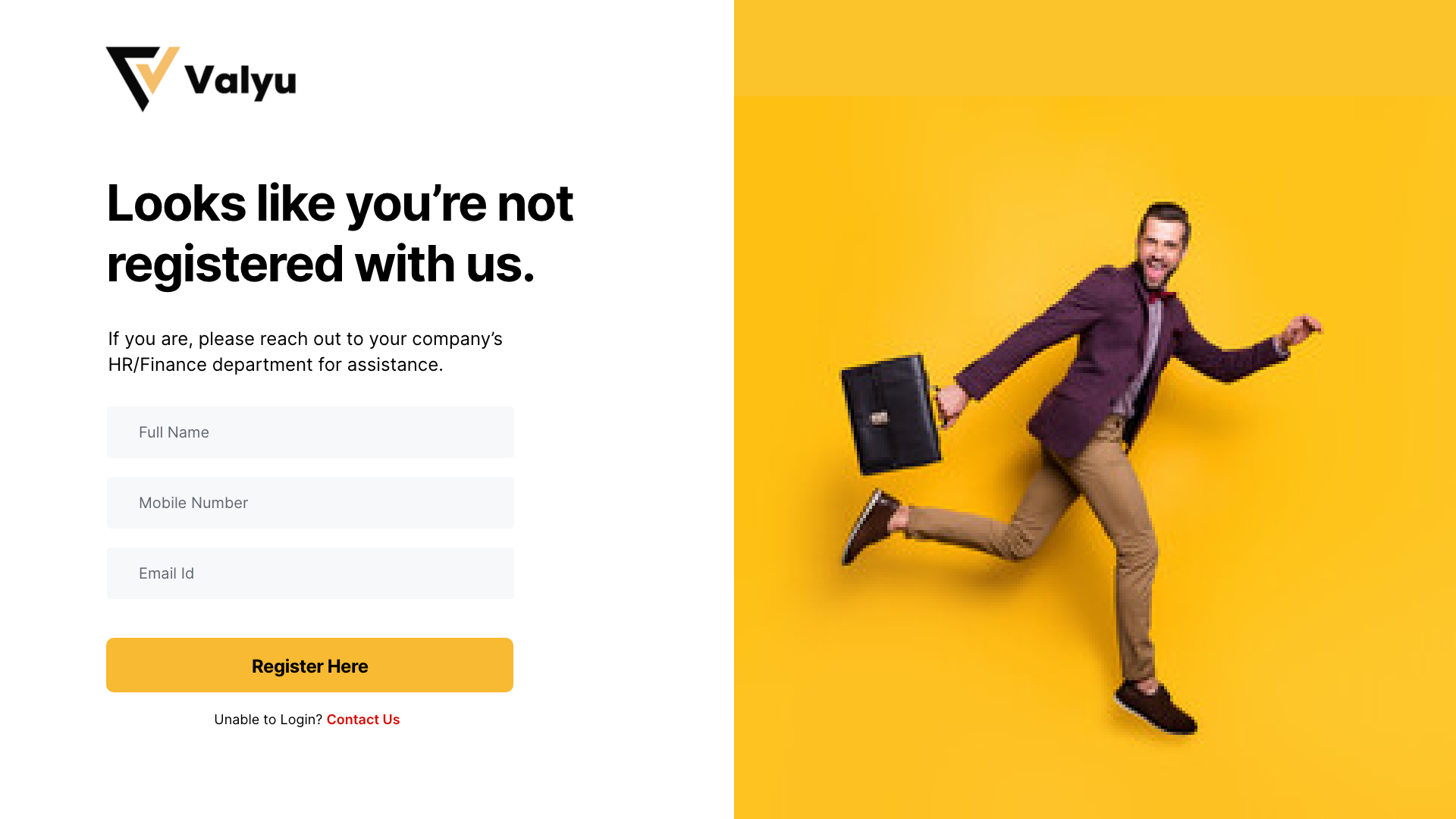

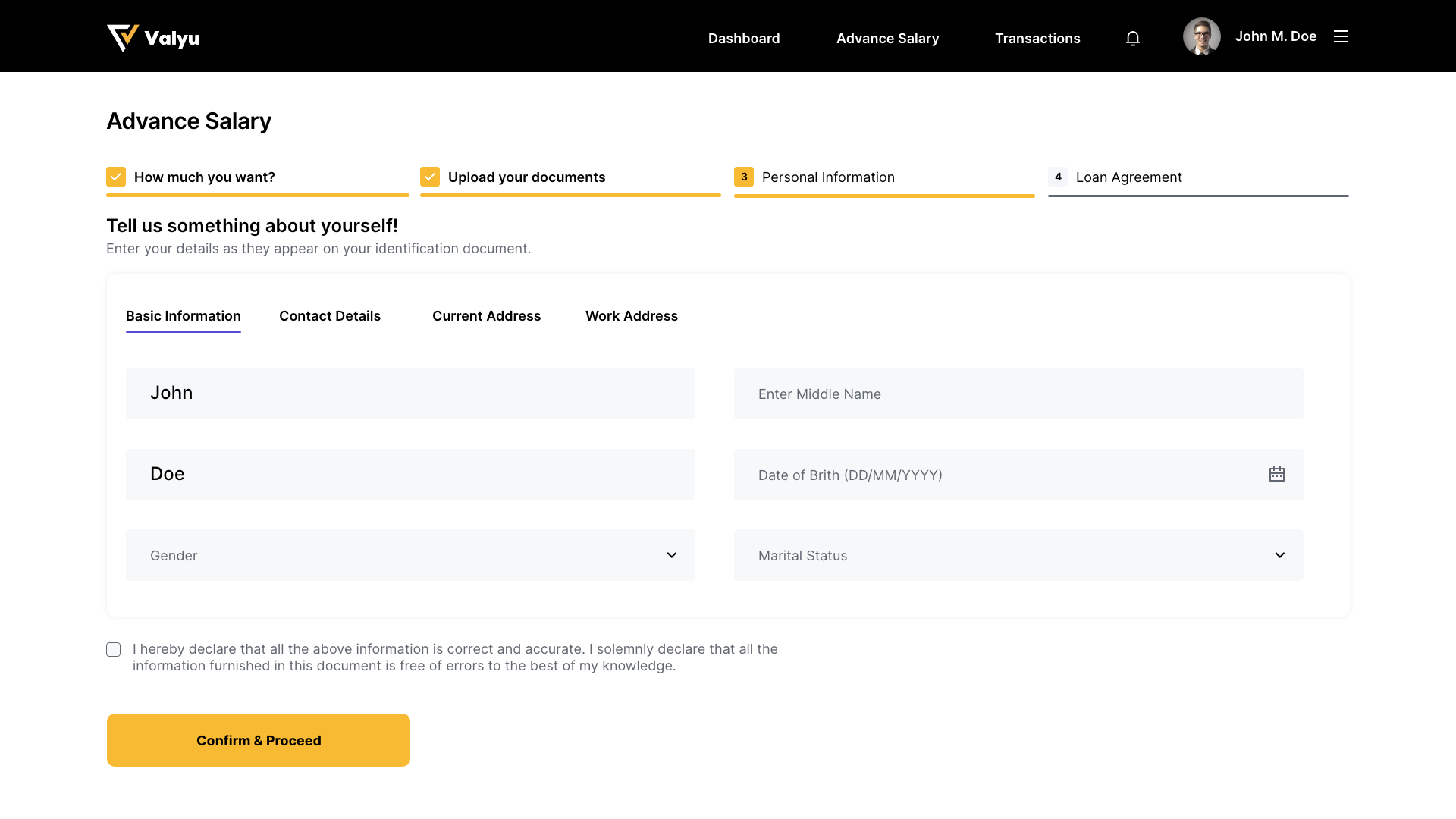

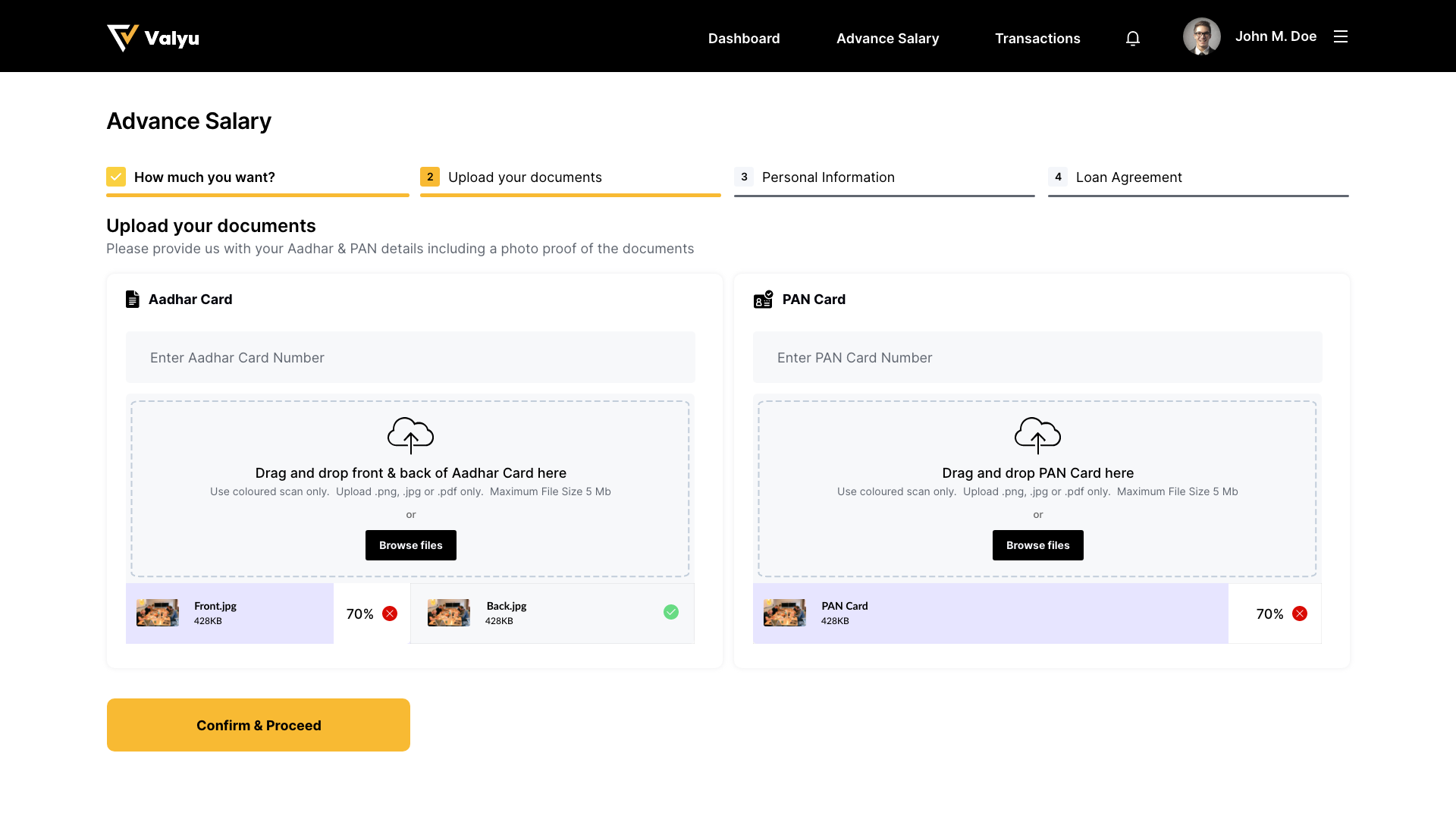

Streamlined Digital Onboarding

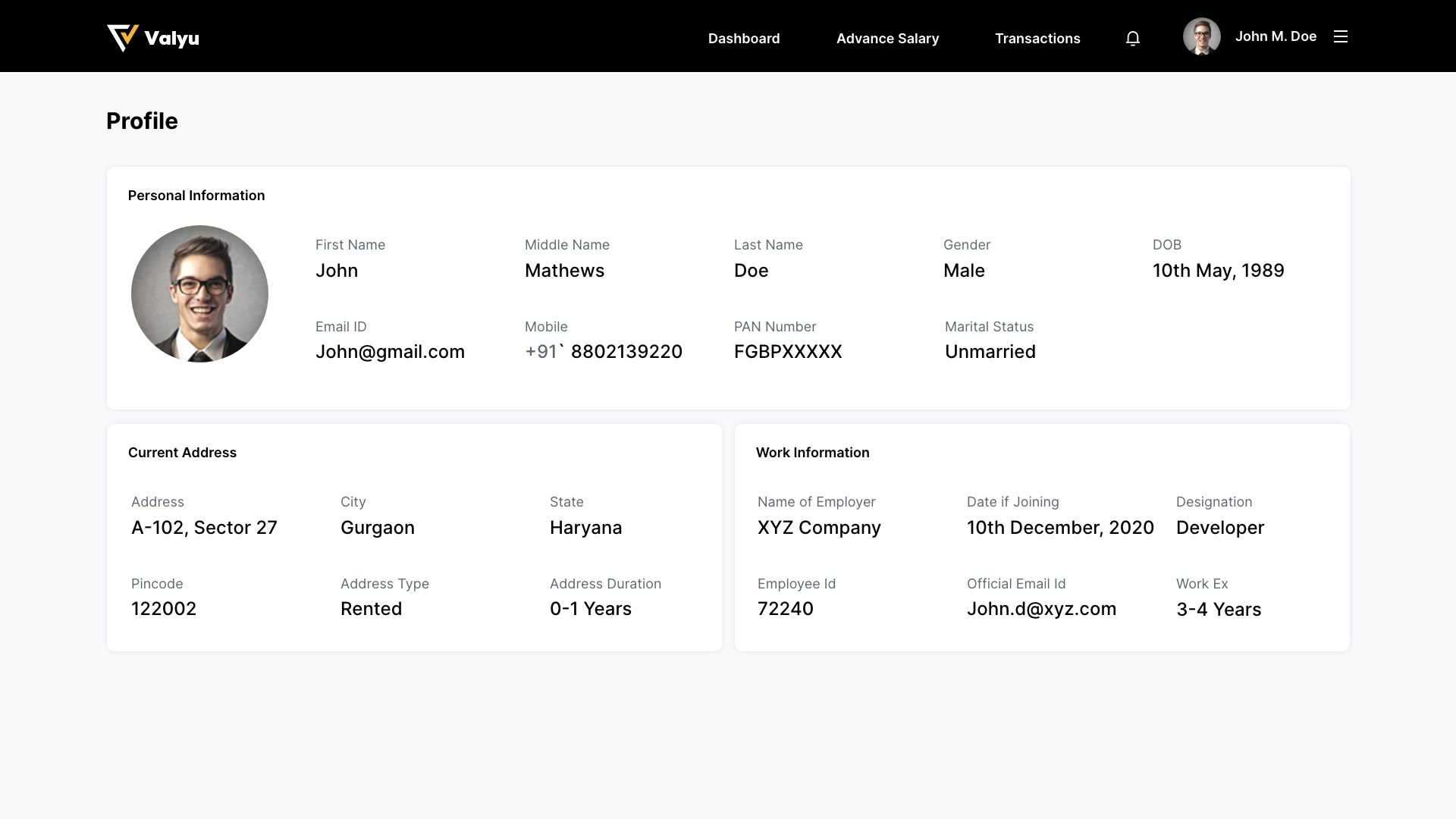

Enabled rapid, paperless e-KYC with easy document submission and quick verification.

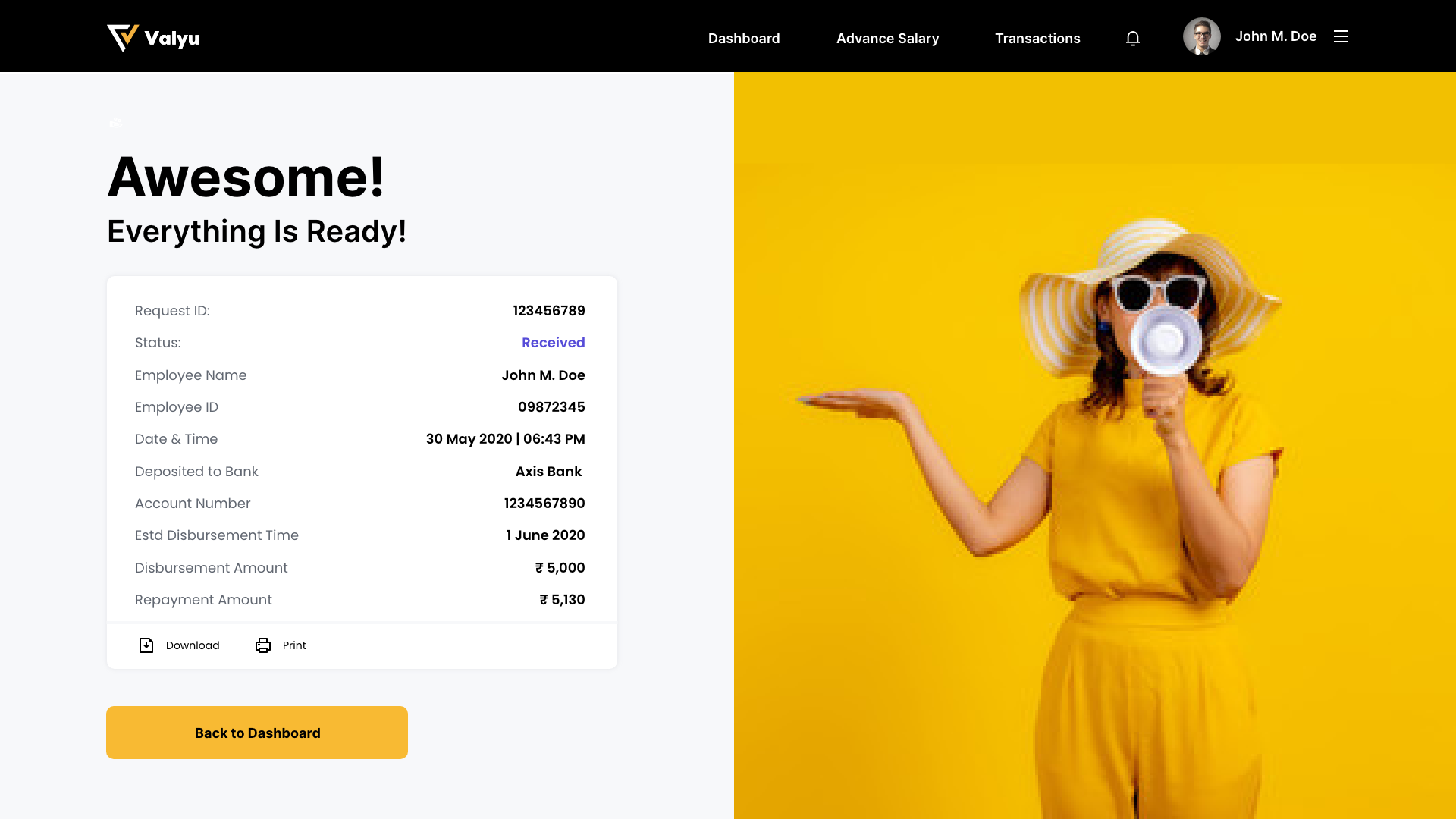

Cross-Platform Ecosystem:

Delivered a unified brand and UX across mobile and web, supported by a scalable cloud-first architecture.

Employer-Centric Integration

Supported adoption via seamless HR/NBFC integration, ensuring trust and data integrity.

Impact

VALYU.ai's innovative approach, powered by a robust digital platform, delivered significant and far-reaching impacts:

Enhanced Financial Well-being for Workforce

The platform empowered over one million Indian workers with instant access to earned wages, directly reducing financial stress and improving overall financial well-being.

Crucial Liquidity Solution & Financial Inclusion

VALYU.ai offered a vital solution for workers facing financial hardships, simplifying access to earned wages and contributing to greater financial inclusion for underserved communities.

Automated & Personalized Financial Management

Leveraging AI and ML, the platform provided a highly automated and personalized experience, adapting to individual customer needs and risk profiles, leading to efficient and tailored financial solutions.

Strong Market Position & Scalability

The robust tech stack and user-centric design positioned VALYU.ai as a leader in the earned wage access space, capable of rapid scaling and continuous innovation.

Strategic Insights & Design Philosophy

My engagement with VALYU.ai was guided by a forward-thinking design philosophy, integrating cutting-edge technology with deep user understanding to reshape the future of earned wage access.

AI-Driven Financial Empowerment

The core strategy leveraged AI and ML as foundational elements for risk management, credit approval, and personalized product offerings, making complex financial decisions simpler and more accessible.

User-Centric Trust & Transparency

Understanding the sensitive nature of personal finance, the design prioritized absolute transparency in fees and processes. Every user interaction was crafted to be clear, straightforward, and reassuring, building inherent trust.

Scalable & Resilient Cloud Architecture

The platform was built on a cloud-first, serverless, and asynchronous architecture across both GCP and AWS, ensuring high scalability, flexibility, and robust performance for managing large user bases and complex transactions.